(And What Smart Homeowners Do Instead)

Paying off your mortgage early is a financial goal many Americans chase. It sounds responsible, it feels safe, and it is often presented as the ultimate symbol of discipline and freedom. However, when you analyze the numbers, opportunity costs, and wealth-building strategies, paying down a low-interest mortgage quickly can actually be a costly mistake.

This article will challenge conventional wisdom. If it makes you uncomfortable, that’s a good sign — comfort rarely leads to smarter financial decisions.

Why Paying Off Debt Feels Safe

There’s nothing morally wrong with wanting to be debt-free. Paying off debt provides peace of mind and a sense of control.

The Math Behind Financial Decisions

However, morality and math are not the same. Many homeowners overlook opportunity cost when accelerating mortgage payments. For example, extra mortgage payments may reduce flexibility and limit long-term wealth creation.

The Hidden Cost of Rushing

Fear of debt, uncertainty, or future income changes often drive people to pay off their mortgage early. In addition, they fail to calculate what that money could have done elsewhere — a blind spot that quietly limits wealth growth.

The Opportunity Cost of Paying Off Your Mortgage Early

Opportunity cost is the return you give up by choosing one financial path over another.

How Prepaying Works

When you make extra mortgage payments, you are:

- Locking capital into an illiquid asset

- Earning a return equal to your mortgage interest rate

- Giving up flexibility and leverage

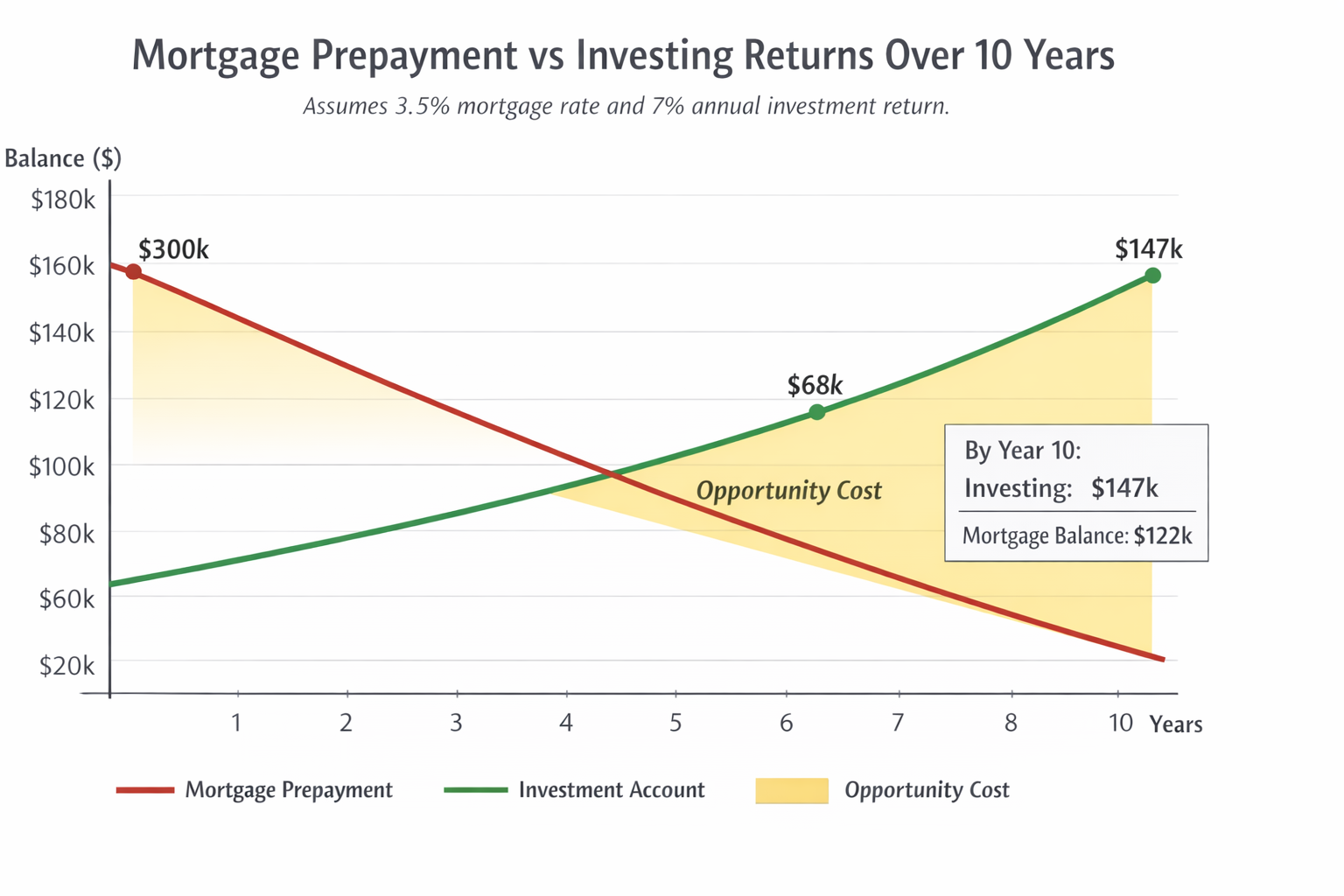

Example: Mortgage vs Investing

- Mortgage rate: 3.5% fixed

- Extra payment: $1,000/month

- Annual extra principal payments: $12,000

Instead of prepaying, investing this $12,000 annually at a 7% return (Morningstar) could produce far greater wealth over 10 years. As a result, the opportunity cost of paying off the mortgage early becomes significant.

Why Paying Off a Low-Interest Mortgage Early Is Often a Mistake

A long-term fixed-rate mortgage is one of the most borrower-friendly financial instruments ever created.

Moreover, while your payment stays the same, everything else changes:

- Rents rise

- Wages rise

- Asset values rise

- The dollar loses purchasing power

Inflation quietly reduces the real cost of your mortgage each year. Therefore, rushing to pay it off removes this powerful advantage.

Liquidity Matters More Than Being “Debt-Free”

A paid-off house feels safe — until life happens.

For instance, liquidity gives you options for:

- Job loss

- Medical emergencies

- Business opportunities

- Market downturns

- Unexpected investments

Home equity is not liquid unless you refinance or sell — both of which depend on credit, income, and market conditions. Many homeowners who pay off their mortgage early later find themselves:

- Cash-poor

- Overexposed to one asset

- Forced to borrow again under worse terms

Consequently, what feels like freedom can quickly become fragility.

What Wealthy Homeowners Do Differently

High-net-worth individuals do not obsess over being debt-free. They focus on:

- Efficiency

- Leverage

- Liquidity

- Flexibility

For example, strategies include:

- Keeping low-interest, long-term debt

- Investing excess capital elsewhere (Forbes: Real Estate Investing)

- Refinancing strategically instead of eliminating leverage

- Integrating mortgages into a broader financial plan

This isn’t reckless — it’s calculated.

When Paying Off Your Mortgage Early Makes Sense

Paying off your mortgage early may be reasonable when:

- Interest rates are high

- Retirement is near and cash flow stability is critical

- Liquidity is strong and assets are diversified

- Risk tolerance is low

Even then, it should be a deliberate, analyzed decision — not an emotional reflex.

Internal Resources for Smart Mortgage Planning

- Learn why It’s the Payment, Not the Rate matters

- Explore No Income Mortgage Loans for strategic leverage

- Check Mortgage Pre-Approval before making payoff decisions

Frequently Asked Questions About Paying Off Your Mortgage Early

Answer: Paying off your mortgage early can seem smart, but for homeowners with low fixed-rate loans, it often reduces potential wealth growth due to opportunity costs, lost investment returns, and inflation.

Answer: Disadvantages of paying off your mortgage early include locking money into a non-liquid asset, missing higher investment returns, and losing the leverage that a low-interest mortgage provides.

Answer: When mortgage rates are low, investing extra cash usually generates higher long-term returns than paying off your mortgage early. The choice depends on your risk tolerance and financial goals.

Answer: Yes. Inflation reduces the real cost of mortgage debt over time, making paying off your mortgage early less financially efficient than investing or maintaining liquidity.

Answer: Wealthy homeowners often avoid paying off their mortgage early to preserve liquidity, maintain leverage, and invest excess capital for higher returns.

Answer: Paying off your mortgage early can make sense if interest rates are high, retirement is near, or you value certainty and peace of mind over growth opportunities.

Answer: Being mortgage-free does not equal financial security. True security comes from liquidity, income stability, and diversified investments—not just paying off your mortgage early.

Answer: Most homeowners benefit more from keeping cash reserves than paying off their mortgage early, as liquidity offers flexibility for emergencies or investment opportunities.

Answer: Decide by evaluating interest rates, investment alternatives, liquidity needs, and long-term goals. Paying off your mortgage early should be a strategic choice, not an emotional decision.

Final Thought: Rates Are Temporary. Decisions Are Not.

Interest rates change. Markets change. Guidelines change.

Poorly thought-out financial decisions quietly compound for decades.

If you want a mortgage, any lender will do.

If you want a strategy, that’s a different conversation. Schedule a confidential strategy call with Mortgage Consultants to evaluate the smartest use of your capital, not just the fastest way to eliminate debt.

Legal Disclaimer: The information in this article is for general educational purposes only and is not legal, financial, or mortgage advice. Mortgage Consultants strives to provide accurate information at the time of publication but makes no guarantees about its completeness or suitability for your situation. Mortgage guidelines and laws change often, and your circumstances are unique. Before acting, consult a licensed mortgage professional, attorney, or financial advisor. Need guidance? Contact us for a free, no-obligation consultation at MortgageConsultants.Net.