Cost Segregation Tax Savings and What Every Investment Property Owner Should Know About

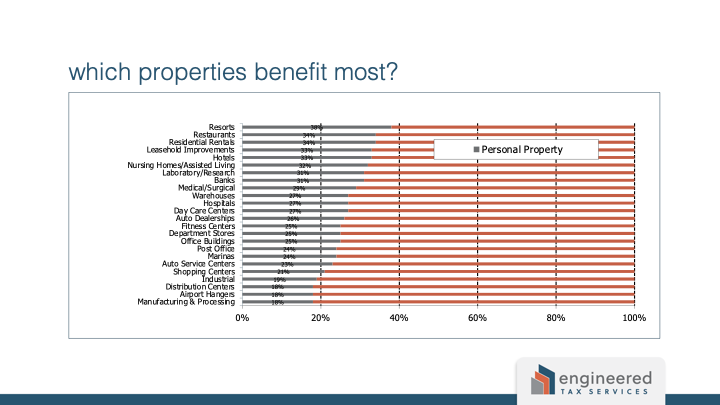

Who Should Consider a Cost Segregation Study?

If you have purchased, constructed, or renovated an investment property, a cost segregation study may

just be the greatest ROI you can immediately receive. These engineering-based studies properly reclassify

the building components according to the IRS guidelines into shorter depreciable lives. This results in

reducing your taxable liability = CASH flow.

As a real estate investor or business owner, you’re constantly looking for ways to optimize your

investments—and cost segregation may be one of the most powerful, yet underutilized, tools at

your disposal.

Whether you’ve recently acquired a property, are planning renovations, or even if you’ve owned

the asset for years, a cost segregation study could open the door to significant tax savings and

improved cash flow.

Let’s walk through what cost segregation is, how it works, and why it might be a game-changer

for your financial strategy.

What Is an Engineered Cost Segregation Study?

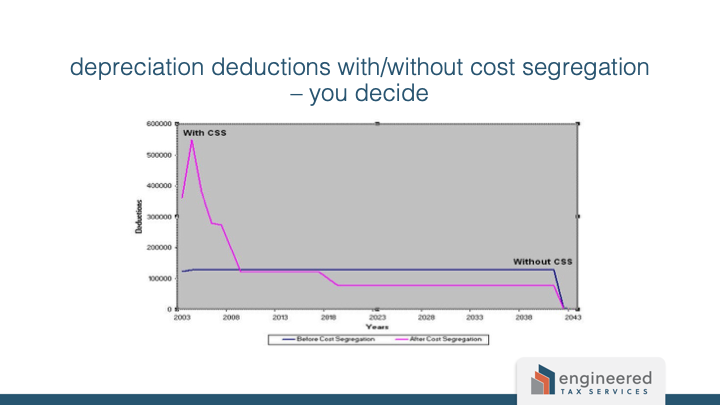

At its core, a cost segregation is the process of identifying and reclassifying certain building

components for faster depreciation. Instead of depreciating your entire property over the

traditional 27.5 years (residential rental) or 39 years (commercial), you can accelerate the

depreciation of eligible components into 5, 7, or 15-year categories.

This isn’t a loophole—it’s an IRS-approved strategy grounded in tax law and engineering-based

analysis.

Cost Segregation Tax Savings: Why It Matters & The Key Benefits

Here’s what cost segregation could mean for you:

✅ Immediate Tax Savings

Accelerated depreciation means larger deductions sooner. This can significantly reduce your

taxable income—especially helpful in the early years of ownership.

✅ Increased Cash Flow

More deductions mean less tax. Less tax means more cash on hand. That’s capital you can

reinvest into more properties, upgrades, or simply keep for your business needs.

✅ Retroactive (“Catch-Up”) Depreciation

Didn’t know about cost segregation when you bought your property a few years ago? No

problem. You can claim all the missed depreciation in the current year—without amending

previous returns—thanks to IRS Form 3115.

✅ Bonus Depreciation Opportunities

The bonus depreciation rate is scheduled to continue to phase down to 20% in

2026 and 0% in 2027.

Cost Segregation Tax Savings: What Building Components Qualify?

What Building Components Qualify?

Here’s a quick breakdown of typical components and their reclassified depreciation lives:

Asset Type Class Life

Carpet, Vinyl Flooring 5 years

Decorative Lighting Fixtures 5 years

Cabinetry and Millwork 5 years

Window Treatments 5 years

Communications & Security Systems 5-7 years

Parking Lots & Asphalt 15 years

Landscaping and Fencing 15 years

Sidewalks, Curbs, Retaining Walls 15 years

HVAC (if dedicated to tenant space) 5-7 years

Electrical for Specialized Equipment 5-7 years

These are just a few examples. Each property is unique, which is why an engineering-based

study is essential to ensure accurate classification.

Cost Segregation Tax Savings: Real-World Examples & Case Studies

Let’s take a look at how this strategy plays out in the real world:

Case Study #1: Office Building – Tampa, FL

Purchase Price: $3.2 million

Year Placed in Service: 2023

Result: $720,000 in first-year depreciation (vs. $82,000 using standard 39-year straight-

line method)

Cash Flow Impact: Over $160,000 in tax savings within the first year

A significant portion of this came from parking lot improvements, interior lighting, and built-in

millwork.

Case Study #2: Boutique Hotel – Austin, TX

Renovation Cost: $2.5 million

Result: $620,000 in assets reclassified to 5 and 15-year lives

Bonus Depreciation Applied: 100%

Savings: $130,000 in immediate tax deferral

This client reinvested those savings into launching a second location.

Case Study #3: Multifamily Complex – Phoenix, AZ

Acquisition Cost: $5.5 million

Reclassified Assets: $1.1 million

Depreciation Accelerated: $990,000 in Year 1

Net Tax Savings: ~$200,000

Outdoor amenities like fencing, lighting, and recreational landscaping were key contributors.

Is Cost Segregation Right for You?

Cost segregation isn’t just for massive portfolios. If you own or are purchasing a commercial

building, a multifamily property, or even a large residential rental, you may qualify.

Generally, a property value of $500,000 or more is where you start seeing meaningful ROI from

a study.

And remember—this isn’t a DIY project. You’ll want a qualified team of tax professionals and

engineers who understand both the construction side and the tax code intricacies.

Final Thoughts

At the end of the day, cost segregation is about putting your capital to better use. Why leave

money on the table when you could be reinvesting it back into your business, growing your

portfolio, or building long-term wealth?

About the Author – Cindy Blumenfeld

In her 15+ years with ETS, she has helped clients generate 100s of millions of dollars in tax savings

for her clients. With a background in finance, she works alongside a unique team of experts

comprised of CPAs, architects & engineers, to provide various niche specialty studies, such as Cost

Segregation, R&D and 179D Energy Certifications.

Cindy Blumenfeld – Director – Engineered Tax Services

Call Cindy: 954-439-1671 Email to Cindy or Connect at Linked-in

Legal Disclaimer: The views, opinions, and recommendations expressed in this article are solely those of the author and do not necessarily reflect the views of Mortgage Consultants or its affiliates. This article is provided for general informational purposes only and does not constitute financial, legal, tax, or investment advice. Readers should seek guidance from qualified professionals based on their individual circumstances before making any decisions. Mortgage Consultants makes no guarantees as to the accuracy, completeness, or suitability of the information provided by guest contributors. Use of this content is at your own risk.

Looking to maximize your real estate investment strategy beyond tax savings? At MortgageConsultants.NET, we help Real estate Investors unlock even more value through smart mortgage planning and investment property financing. Whether you’re purchasing, refinancing, or expanding your portfolio, our expert loan advisors are here to guide you every step of the way.

Schedule your free consultation today and discover how strategic financing and cost segregation can work together to build long-term wealth.